West European electric car market remains ahead of China

- Matthias Schmidt

- Sep 15, 2020

- 2 min read

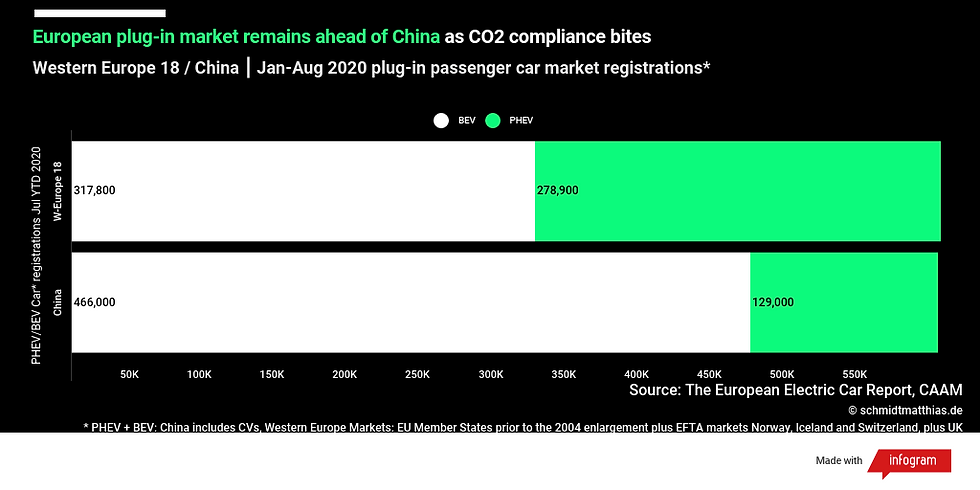

According to the August edition of the European Electric Car Report industry publication, published next week, the exclusive data shows that during the opening 8-months of 2020 the West European (18 markets) passenger car market continued to outpace China's market, in volume terms, by a paper thin margin.

The West European passenger car market, made up of the original EU member states prior to the 2004 enlargement plus EFTA member states Norway, Switzerland and Iceland, witnessed total new plug-in (BEV/PHEV) passenger car registrations reach 597,000 units, during the opening 8-months of 2020, thanks to the just under 0.1 million units added in the month of August and consequently remains on course to achieve 1 million units this year, having surpassed prior full year totals already (2019: 546,000).

Consisting of combined PHEV and BEV volumes, boosted by generous government and OEM backed purchase subsidies, as well as fiscal subsidies in major markets in a response to the corona pandemic and assisting OEMs in meeting tougher EU (+ EFTA and UK minus Switzerland) wide fleet average CO2 emissions legislation phased-in this year, saw both categories boosted in the usual quieter month of August. BEV volumes recorded their fourth highest monthly volume, resulting in only the third time that an above 6 per cent (6.2%) monthly BEV penetration has been achieved in the region (full data can be found in the report).

While West European BEV registrations reached 318,000 units so far this year, PHEVs reached 279,000 units combining in a plug-in market of 597,000. Although Chinese plug-in volumes were higher in the month of August Western Europe was able to stay ahead after 8-months by a whisker thin margin of under 2,000 units, although CAAM supplied Chinese data also includes commercial vehicles also.

More in-depth analysis is available each month in the European Electric Car Report, available on a monthly or annual basis here

Comments